Communications

Microcap Bulletin – Q1 2021

Dear investors,

Despite a challenging last year on a social level, but a great one in the financial markets, we started the new year with optimism. Now that vaccines are beginning to be administered on a large scale and government financial interventions are still massive, economic recovery prospects are excellent in the short to medium term.

The first quarter got off to a strong start for microcaps, as the sector outperformed large caps, particularly on the US side.

The quarter ended with a period of volatility and a slight decline during the last three weeks, before finally picking up steam at the start of the second quarter.

Let’s now take a look at some Fund’s metrics as at March 31st, 2021:

- $15.8 million in net assets under management.

- 90 % was invested and 10 % remained in cash.

- 32 positions. The largest represented 14.5 % of the portfolio.

- The top 5 positions represented 37 % of the portfolio.

- Fund unit value of $10.43*, for an overall return of + 10.4 %** during the quarter.

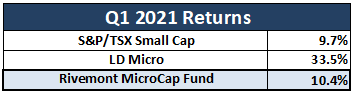

** Net return after all fees.To compare our performance during the first quarter (January 1st to March 31st, 2021), we use the S&P/TSX Small Cap Index as our benchmark. This index reflects the small cap market performance in Canada. To get an overview of the US market performance, we refer to the LD Micro Index. Here is the performance of the two indices during the quarter:

All in all, we are quite happy with the fund’s performance for the quarter. We have observed a significant gap between the performance of small caps in the US (LD Micro) compared to Canada (S&P/TSX). Unfortunately, we did not benefit from this divergence, given our 99 % exposure to the Canadian market. We believe it is in our long-term interest to focus on the Canadian market, given it is the market we know best and in which we have developed our expertise over the last several years.

That being said, we occasionally look at opportunities on the US side and even more so now that our team has grown with Mathieu Martin and Philippe Lapointe’s arrival as analysts at Rivemont.

New Private Investment

In March, we invested in a third private company since we launched the microcap strategy. This time, we purchased a convertible debenture in Charbone, a renewable energy company with a goal to be one of the leading operators of green hydrogen and supply exclusively hydrogen produced from renewable electricity. With this goal in mind, the company wants to acquire several hydroelectric dams in the United States.

Decarbonizing our economy is a hot topic that we hear a lot about lately, and with good reason. It is essential that we collectively make efforts to slow global warming, and it’s why we are so happy to help Charbone move this mission forward.

We were highly impressed with the company’s management team, who has a remarkable track record and decades of experience in the renewable energy sector.

We expect Charbone to go public on the TSX Venture in the coming months.

Recent Changes To The Fund’s Classes

Last month, we decided to simplify the fund’s class structure by combining class A and B investors into a new class A and moving class C investors into a new class B.

Don’t be surprised if you notice that you have changed classes on your next statement.

You will not see any change in terms of management fees if you were formerly in classes B or C. The only positive change relates to the old class A, which is now part of the new class A with lower management fees (1.75 % per year instead of 2.00 %).

From now on, class A will be for investors with $999,999 or less in the fund, while class B will be for investors with more than $1 million.

Since class A now includes the vast majority of investors in the fund, we will now refer to this class going forward to present the returns in our quarterly communications.

Outlook

Our last quarterly letter mentioned that our approach was gradually turning towards caution given the high valuations in the stock market. Three months later, our approach remains similar.

We are still clearly in a bull market, and the outlook for the reopening of the economy is excellent, which encourages us to hold most of our positions for the long term. However, we are a little more cautious about stocks that we believe to be excessively overvalued. While we take some profits, we reallocate the capital in less risky stocks that we think have an excellent margin of safety in the event of a market correction. We also maintain a good cash position (about 10 %) to act quickly if opportunities arise in the future.

We believe that this balanced approach will allow us to take advantage of the nice gains that remain to come in this bull market while reducing the downside risk somewhat if we experience a correction.

As usual, don’t hesitate to call or email us if you have any questions regarding your investments or if you wish to refer friends and family members who are looking for a profitable alternative strategy for their portfolio. In this regard, please note that the minimum initial investment in the fund has recently increased to $100,000.

Thank you for your trust, and we look forward to our next communication!

Rivemont Investments

Portfolio Manager of the Rivemont MicroCap Fund

Units of the Rivemont MicroCap Fund are available under exemptions from the prospectus requirements, pursuant to National Instrument 45-106 Prospectus and Registration Exemptions, and are available only to qualified investors, including portfolio manager clients. This document is not a recommendation nor an investment advice and is presented for informational purposes only.

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive the Microcap bulletin by email:

Similar letters

Update – 1st Semester 2023

We have often discussed risk appetite and how it influences investors’ interest in the microcap asset class. During these first six months of 2023, we can say that risk appetite was partially back.

Read more >Monthly Update – May 2023

We’ve been sending you monthly video updates for sixteen months now. This period allowed us to experiment, learn and better understand the benefits and drawbacks of this new form of communication.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.