Communications

Volume 13 Number 2

Introduction

Hello everyone,

- Hello Martin.

- Hello Mr. X.

- Yeah, the markets aren’t easy…

- You’re right, there’s a lot of volatility.

- Yikes! $270,000, that gave me quite a jolt, but I understand, it’s difficult for everyone.

- In fact, I don’t think you looked at your account well; you can’t forget to add the U.S. portion. You actually have $351,000 dollars and you’re up since the beginning of the year.

- Oh, really?

- A big thank you, then, we’ll talk again in the coming weeks.

That is a real conversation I had recently. I have been saying since the launch of Rivemont that it’s not when everything is going well and your brother-in-law’s niece’s neighbour’s sister obtains excellent returns that it’s possible to judge a manager’s skills, but rather when times are more difficult and opportunities are less obvious to the average person. One of the best-known sayings of Warren Buffet that I quote when appropriate is this: “Only when the tide goes out do you discover who’s been swimming naked.” In other words, it takes a full business cycle to see who is doing best.

This financial letter will be a little different from the others as I will focus in the first part on a single asset class: equities. Some Rivemont clients own a combination of products and alternative funds, but most own a significant portion of stocks, and it is often this portion that will have the greatest impact on performance. As usual, we will conclude with our market outlook and our largest positions.

Happy reading!

Equities

Over the past two years, the annualized gross return on the equity portion of our traditional strategy portfolios has been 25.2%. And the year-to-date return is also very positive. You can click on the following link for performance details:

https://rivemont.ca/wp-content/uploads/2021/02/Actions-2022-03-1.pdf

As at April 17, 2022, the year-to-date return for the S&P 500 was -7% and for the Nasdaq, -14%. So in this part of the newsletter I will explain what we have done differently over the past few months to help our clients avoid losses.

But first, in addition to gains, one of the premises of successful investing is to avoid losses. Since the beginning of the year, a multitude of U.S. technology large caps have been destroyed in the markets, including Meta (Facebook) down 38%, Spotify off 41% and Netflix down 43%.

Meta, FB, TradingView

The Canadian markets were not immune to the downturn, with our leading tech companies also experiencing sharp declines. Lightspeed lost 50% of its value and Shopify was down 58% over the same period.

SHOP, TradingView

It is at these times that we realize that the approach of buying stocks and holding them forever is not always optimal. We, too, held shares of companies like DocuSign and Etsy in our portfolios and those stocks also collapsed in recent months. The important thing is to sell those stocks at the right time, which is usually just a little too early.

So for us, 2021 wasn’t our best year, because we started rotating out of these high-growth technology companies and into more financially sound companies, including those in the resources and materials sector. You can’t be afraid of missing the last leg of a market uptrend, as current events have shown us.

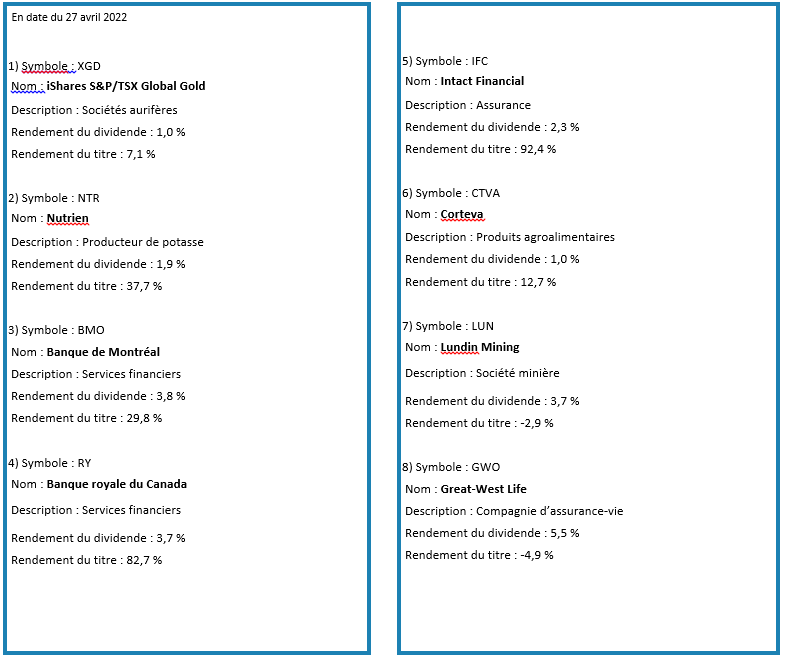

This rotation was done at two separate times over the past year. First, we eliminated the riskiest stocks in our portfolio, the ones that we felt were the most at risk of a revaluation due particularly to rising interest rates. We replaced them with Canadian financials, such as Bank of Montreal and Great-West Life Insurance Company, while maintaining a sizeable cash portion.

BMO, TradingView

Second, we integrated the resources sector into the portfolios. And it is this aspect of our process that we would like to discuss in greater detail to show you its importance. We knew that in inflationary times the materials and resources sector usually outperforms the market. In addition, due in part to ESG (environmental, social and governance objectives) considerations in the capital market, there has been significant underinvestment, especially in the West, in materials extraction companies like mines and fossil fuel producers. So while we shared the environmental concerns raised by these major projects, we were also certain that this situation would act as a trigger for what’s called a “commodity supercycle.”

Our first purchase in the sector was mining giant Nutrien (NTR), the world’s largest producer of potash and other fertilizers. The agri-food sector usually responds very well to inflationary pressures because it can pass price increases on to consumers. However, in this particular case, the luck factor was also in our favour. In addition to Canada, the other largest fertilizer producer is Russia. Due to the surprising and catastrophic invasion of Ukraine, the price of potash and various fertilizers has exploded in the markets to the point where there is talk of shortages for some of the major producing countries like Brazil. So the timing couldn’t have been better.

NTR, TradingView

In the same sector, we also bought Cortiva (CTVA) for our clients. This Indiana company develops modern, resistant seeds and digital decision-optimization solutions for farmers. It is also involved in the development of preservatives for agricultural production.

Lastly, I would like to talk about one more company, Lundin Mining, which we have incorporated into our portfolios. In fact, this is a company that we have owned in the past and that is returning to our portfolios. This mining company, which specializes in the extraction of metals such as copper, zinc, nickel and gold, has properties in Brazil, Chile, Portugal, Sweden and the United States.

In our view, the electrification of the economy should increase demand for copper, which is already a very tight market. The price of this metal should continue to climb, and Lundin will greatly benefit from this rise in prices. In fact, we expect the price of all base metals to rise as a result of the underinvestment we’ve already talked about. In particular, the price of gold should continue to climb, due particularly to current geopolitical risks.

Copper price, Knoema

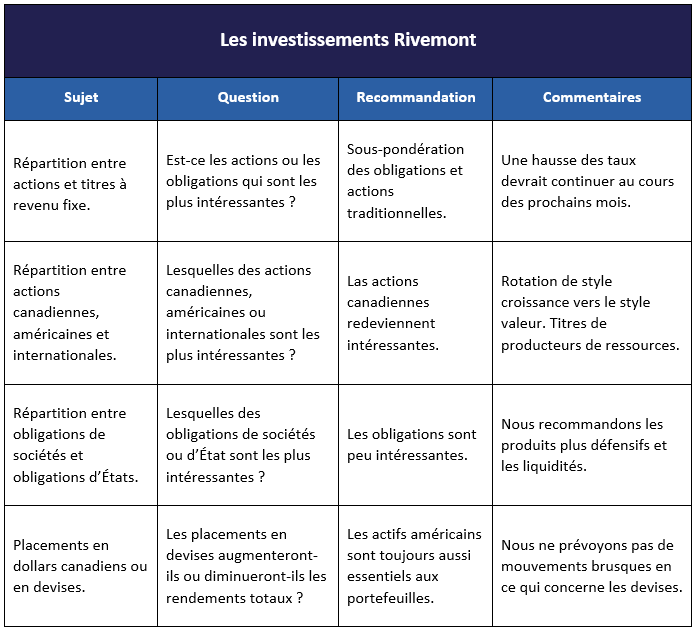

Market Prospects

Favorites Securities

Conclusion

In closing, I would like to take this opportunity to welcome Rivemont’s new clients from Cape Cove Private Wealth. We are pleased to welcome you and look forward to working with you to enhance your current portfolios.

Ongoing events demonstrate once again that our trend monitoring and sector rotation approach is delivering real benefits, especially in times of market instability. Please feel free to recommend us to your family members who have had a more difficult time in recent months.

Sincerely,

Martin Lalonde, MBA, CFA

President

The information presented is dated March 31, 2022 unless otherwise specified and is for information purposes only. The information comes from sources that we deem reliable, but its accuracy is not guaranteed. This is not financial, legal or tax advice. Rivemont Investments is not responsible for errors or omissions with respect to this information or for any loss or damage suffered as a result of reading it.

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.