Communications

Volume 13 Number 1

Introduction

Hello everyone,

Needless to say, I’m glad that 2021 is behind us and wish everyone a less tumultuous social and professional life in the new year. Still, despite the pandemic’s major inconveniences, Rivemont maintained its rapid growth of recent years, and we now have close to $100 million in assets under management. I would like to take this opportunity to thank everyone who rolled up their sleeves to tackle the challenges that arose.

The team grew stronger during the year as Valérie Marquis joined us to focus on client development and relations, and Mathieu Martin was appointed portfolio manager of the Rivemont MicroCap Fund. Congratulations also to Philippe Lapointe, who succeeded brilliantly on his first step toward his CFA designation.

Reflecting the market, there was a marked variance in the performance of our Rivemont strategies during the year. However, a diversified portfolio featuring these strategies produced an attractive positive return. I therefore intend to review each of these strategies in detail in this message, while leaving cryptocurrency to its own weekly newsletter. We are also working on a separate communication for the Rivemont Alpha Fund. As usual, we will conclude with our market outlook and an outline of our largest positions.

Enjoy!

Private Wealth Management

After a mixed start, the equity portion of our private wealth management portfolios closed the year on a high note with a 12.1% return in the fourth quarter and 6.6% in December alone. Over the year, we gradually shifted our positioning toward value stocks, and this decision has paid off considerably in recent months.

Although purchases are important in portfolio management, sales are even more so, in my opinion. And this may be the hardest thing to grasp for beginners in this field.

Docusign ranks among the stocks that contributed most to our success in recent years. However, selling proved to be a critical decision in this case also to take profits that could be injected in our other better investment ideas.

Both securities mentioned above have lost 72% and 51% of their value respectively since their peak last fall. Thanks to our trend monitoring and sector rotation approach, our investors benefitted from the market rise and avoided the worst of their downturn.

During the year, we also reduced bond exposure by half in our traditional strategies. Since rates are expected to continue rising in coming months, and this will possibly push bond prices down, we decided to protect capital while waiting for better days for this asset class.

Rivemont MicroCap Fund

To be honest, 2021 was a difficult year for our Rivemont MicroCap Fund strategy. After seeing the fund appreciate by more than 15% in the first few months, we witnessed a slow collapse for most of the last nine months of the year.

Sector exposure proved to be an important factor in its underperformance. The Rivemont MicroCap Fund is 49% exposed to the technology sector, while Canadian and U.S. indices are 5% and 13% exposed respectively. Energy and basic materials, two sectors to which we have little or no exposure, performed particularly well.

Looking back, we believe that the key takeaway from this difficult year is that our investment style and strategy didn’t bear fruit in 2021. That said, we are confident that this strategy will continue to stand out in the long term, as it has over the past four years. In order to give you a longer-term perspective of our performance against the indices, here are the fund’s annualized returns since its launch in January 2018:

As we’ve said many times, keep an eye on the long term, both during the good and less good years. While periods of underperformance are extremely frustrating, they are necessary and unavoidable in the pursuit of a differentiated and successful long-term strategy.

Three Key Assumptions

We believe three key assumptions justify investing with Rivemont.

- First, the equity market of companies with small or mid capitalization will eventually outperform its large-cap counterpart.

For many years, the large caps have been dominant, particularly the FAANG stocks,[1] driving the U.S. indices up with their exceptional performance. Nevertheless, bear in mind that small caps have always generated better returns than large caps over the very long term. The current trend should reverse itself sooner or later and leave room for the small caps to outperform.

- The stock market presents tremendous opportunities for a good active manager to stand out.

The Canadian market has more than 4,400 exchange-listed companies, of which over 3,000 are considered to be microcap companies (market capitalization less than $300 million). While the major financial institutions that manage large sums of money focus on the most mature 1,000 to 1,500 companies, the other 3,000 are left in the hands of retail investors and small investment funds like ours. The market abounds with inefficiencies and opportunities for a full-time team that does its research thoroughly. This is a area where the likelihood of outperforming the market is high.

- Rivemont is an active manager that can beat the market.

This is certainly the most critical assumption. Next, since there is little certainty in this world, we again emphasize our returns history over the past years as proof of our ability to beat the market.

Finally, it is critical that you have confidence in our management team and investment philosophy, which is to hold a portfolio focused on high-quality, fast-growing companies.

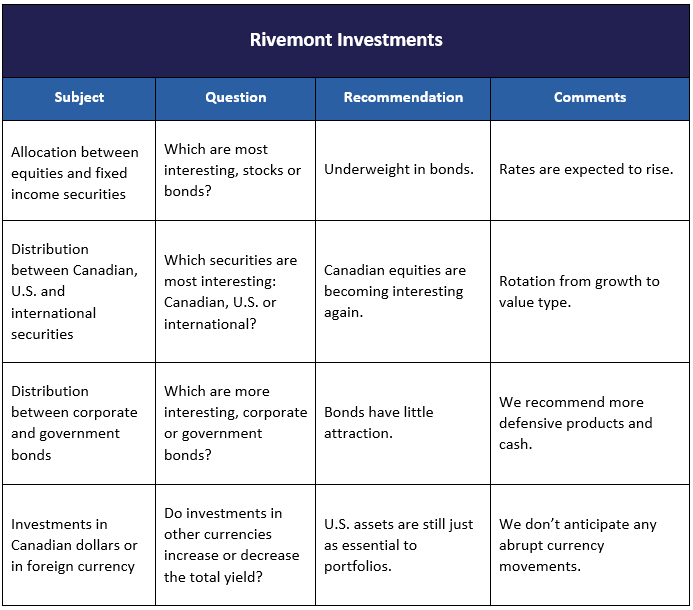

Market Prospects

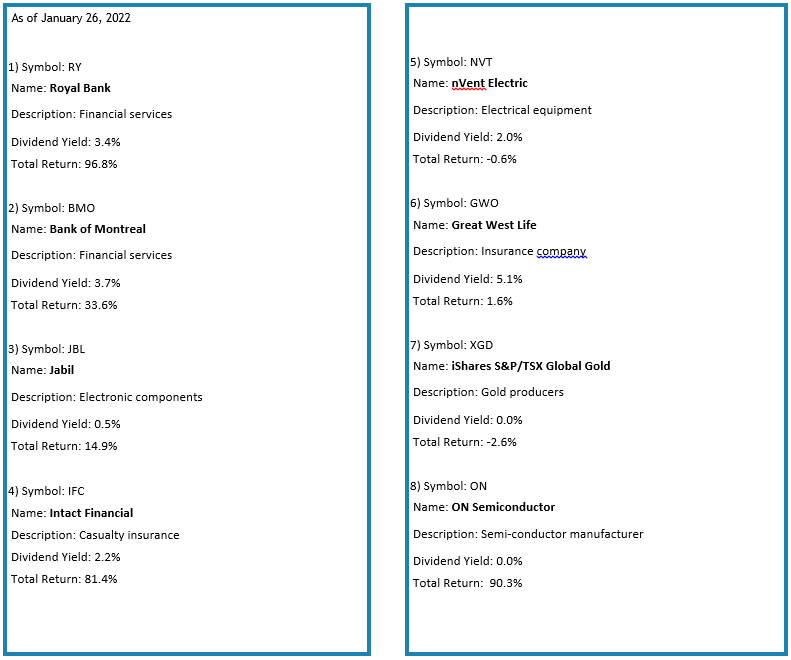

Favorite Securities

Conclusion

We’re optimistic about 2022 and confident we’ll be able to continue adding value to the portfolios of investors who have placed their trust in us.

On another matter, if you hadn’t heard, Martin Lalonde is now a financial columnist for Les Affaires. To access this content and other articles, please visit the “Rivemont in the media” section of our website

Happy 2022, everyone!

Martin Lalonde, MBA, CFA

President

The information presented is dated December 31, 2021 unless otherwise specified and is for information purposes only. The information comes from sources that we deem reliable, but its accuracy is not guaranteed. This is not financial, legal or tax advice. Rivemont Investments is not responsible for errors or omissions with respect to this information or for any loss or damage suffered as a result of reading it.

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.