Communications

Volume 12 Number 4

Introduction

Hello everyone,

As the third quarter of 2021 draws to a close, markets are slowly making the transition that we have expected for several months. The more solid “value” stocks are starting to regain strength while “growth” stocks are showing certain signs of fragility. Last spring, we eliminated several stocks that we considered more speculative in order to implement a more conservative approach. As a result, our portfolios are a bit duller and less exciting. Our sector rotation approach seeks to overweight the sectors that we find most attractive in the medium term and underweight those we don’t like as much. We believe that the technology stocks of the second tier are now distinctly over-valued compared to their profit potential. It is therefore important, in our view, for investors to fully divest these positions in their investment portfolio.

In this newsletter, we will review the decisions we made in private wealth management to establish a high-return strategy while protecting ourselves against a market reversal. I will then give more detail on the method we are introducing within the Rivemont Alpha Fund to take advantage of market volatility. I will continue with an overview of the Yale University model and conclude with our market outlook and our largest positions.

Enjoy!

Private Wealth Management

To outperform the major indices in the long term, it is important to establish a rigorous decision-making process. Over the past two years, it has become increasingly obvious that new investors are entering the stock market without a clear strategy and are still able to achieve good results. The last time I saw this kind of behaviour was in 1998-99, just before the tech bubble burst. I never thought I would see that kind of euphoria again, but I must admit that this is an equally interesting time.

The beauty of this kind of period is that opportunities turn up where we least expect them. It may be easy to follow the herd and concentrate one’s portfolio in fast-growing technology companies. However, the risk associated with these types of companies is also increasing considerably.

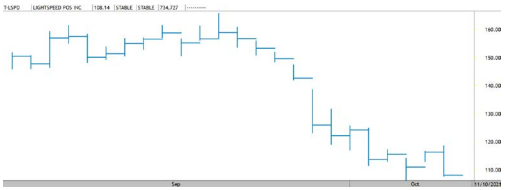

Take the Montreal firm, Lightspeed Commerce, for example. This is a company we have loved and followed for a number of years. We have held its shares (LSPD) twice in our private wealth management portfolios and sold them at a profit both times. However, there came a point when the market valuation was no longer justified.

We weren’t the only ones to think so. This past September 2, a New York hedge fund, which had sold its LSPD shares short, released a devastating report on the company’s finances. The report is available at the following link:

https://www.sprucepointcap.com/lightspeed-commerce-inc/

Over the past few weeks, the company’s shares have lost more than a third of their value on the Toronto Stock Exchange. This is the kind of risk that we’re not prepared to take.

We replaced LSPD with one of the most undervalued companies we know of: Great-West Lifeco. Trading at 10 times earnings and 0.6 times sales, it is certainly a bargain. It also provides good protection in the event of a market downturn.

The thing to remember here is that our portfolio, which still contains a handful of growing technology companies, is now positioned to cope with less easy and more volatile markets.

Rivemont Alpha Fund

While we protect ourselves in private wealth management by reducing the degree of risk, the Rivemont Alpha Fund can cheerfully profit from market downturns through short selling. And that’s the tactic we have started to use.

The fund’s objective is to leverage market volatility to take advantage of short- and medium-term trends. For example, while the 2020 second quarter was obviously positive, the Rivemont Alpha Fund took advantage of it to generate an annual return of more than 35%. Right now, however, we believe that some sectors are overvalued and on the verge of faltering.

Here is an example of a short sale we executed in this fund in the last quarter.

Amedisys is a home healthcare provider. The fundamentals are falling and the valuation remains high. For several months, the company’s shares have been in free fall and our analyses showed no signs of a reversal. We waited for the decline to reach $174 to sell short. We covered our position at close to $145 to secure a quick and substantial gain.

Rivemont is a firm that, on the whole, performs better when conditions are less favourable because of its active management and also because most of our investors hold a position in the Rivemont Alpha Fund. An absolute return strategy is essential for any modern investor and it is best to adopt one before paying the price.

The Yale University Model

An asset can be defined as “alternative” when the expected yield curve differs from that of equities or bonds. As such, when an alternative asset is added to a traditional portfolio, the portfolio risk is usually reduced with no negative impact on the long-term return.

At present, the traditional financial distribution network in Canada and Quebec unfortunately does not allow investors to take full advantage of these more efficient portfolios. However, large institutions have quickly incorporated this approach in the construction of their investment portfolios.

The pioneer in integrating alternative assets into portfolio management is certainly David F. Swensen, who is responsible for managing the enormous endowment of Yale University in Connecticut. Swensen began his career on Wall Street with Salomon Brothers and Lehman Brothers, where he quickly became an expert in derivatives, particularly currency swaps.

In 1985, at the young age of 31, he received an offer to direct the financial management of the endowment, which was then close to $1 billion. During this period, he was well advised by his mentor and future winner of the Nobel Prize in economics, James Tobin, one of the pillars of modern portfolio theory.

He revolutionized the traditional approach by making three big decisions.

- Shift away from asset classes with historically low returns, such as bonds and commodities.

- Promote a broad diversification of asset classes in the portfolio by including emerging markets, absolute return strategies, real estate, private placements and venture capital.

- Invest without hesitation in assets of very low liquidity in order to take advantage of the time premium.

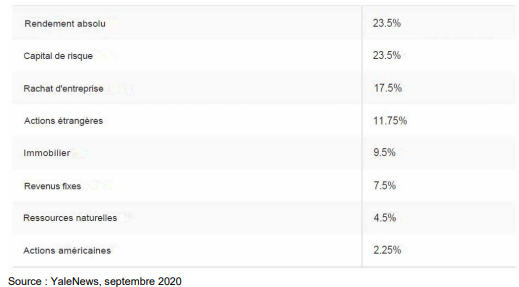

While U.S. equities and fixed income securities accounted for more than 75% of the portfolio in the 1980s, they now represent less than 10%.

Obviously, we wouldn’t talk about a revolution if the performance had not been exceptional. Over the past two decades, the return reached 9.9% a year compared to the U.S. college average of 5.6%. This amounts to almost $26 billion in excess value that is used notably for university operations, faculty salaries and scholarships.

Astonishingly, this high-return approach is diametrically opposed to the one proposed and used by many financial advisors. In fact, it is not unusual nowadays for portfolios to be composed almost exclusively of North American equities. This can be explained largely by the accessibility of this asset class, which has been among the top performers during this bull market that has lasted more than 12 years to date.

A simple mathematical calculation demonstrates the undeniable advantage of a portfolio composed of asset classes that are not perfectly correlated. For example, consider two hypothetical returns over three years.

Example 1:

Year 1: 8%

Year 2: 12%

Year 3: 10%

Average return: 10%

$100,000 invested is worth $133,056

Example 2:

Year 1: 25%

Year 2: -10%

Year 3: 15%

Average return: 10%

$100,000 invested is worth $129,375

So average return is not the only important variable to optimize the performance, and that’s the whole point of diversification. It is just as important to minimize overall portfolio risk in order to maximize its return.

For example, let’s examine the absolute return strategy that is currently the largest in the Yale University endowment portfolio. This asset class had the lowest return in the portfolio over the past 20 years. However, its usefulness is due to the fact that this strategy is without a doubt the most appropriate in bear markets or even stock market crashes, such as in 2008-2009, or March 2020. As illustrated in the hypothetical example above, this strategy greatly reduces losses and therefore diminishes the portfolio’s risk level when needed. Lower volatility in results, especially when they are falling, allows for greater long-term enrichment.

Market Prospects

Favorite Securities

Conclusion

I would like to remind you that the Rivemont Crypto Fund, currently our highest-return strategy, has its own weekly newsletter. We would be pleased to add you to the mailing list should you request it.

In traditional markets, we have started a rotation from growth sectors toward more defensive ones. We should continue this movement in the coming months and not rule out increasing cash in the portfolios as well. We prefer to have the cash available when opportunities arise, as we did in the wake of the sharp market downturn at the start of the pandemic.

Thank you for your confidence.

Martin Lalonde, MBA, CFA

President

The information presented is dated September 30, 2021 unless otherwise specified and is for information purposes only. The information comes from sources that we deem reliable, but its accuracy is not guaranteed. This is not financial, legal or tax advice. Rivemont Investments is not responsible for errors or omissions with respect to this information or for any loss or damage suffered as a result of reading it.

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.