Communications

Volume 12 Number 3

Introduction

Hello everyone,

Time flies. The pandemic began more than 18 months ago and so much has changed. It’s hard for us to believe that the stock market is now hitting new highs week after week. In fact, central bank intervention has been such that all assets are now in a bull market. Lumber, canola oil, used cars, maritime transport, food: all are strongly on the rise. However, if we dig deeper, particularly in the stock market, we see that everything is not so rosy. We’ll discuss the result of this review in the first part of this financial letter.

I would also like to take this opportunity to announce that Valérie Marquis has joined the Rivemont team. She will work out of our Montreal offices. Specializing in high-net-worth clients, she has worked for several major Canadian financial institutions. She is currently registered with us as an exempt market representative and is pursuing the portfolio manager designation. In particular, she will be responsible for development and investor relations. We consider ourselves fortunate to be able to strengthen our team with someone of this calibre.

In this letter, we’ll review the past quarter, including the equity market. After that, we’ll announce an interesting project that we’re working on concerning insurance. Then, as usual, we’ll present our market outlook and our largest positions.

Enjoy!

Second Quarter 2021

In the last century, Joseph Kennedy – John’s father – said a week before the 1929 stock market crash: “If shoeshine boys are giving stock tips, then it’s time to get out of the market.” These days, not a week goes by without people with no financial background speaking to me about trade or speculative stocks. In our view, we’re in what’s called a “euphoric” period in the markets. I’m not saying it’s unhealthy, though. I myself started my career during a record period, in 1999-2000. However, this is an additional sign that caution can occasionally be beneficial to the average investor.

Furthermore, one cannot discuss the current situation without mentioning the composition of the indices. Currently, whether directly with a broker or online with a robo-advisor, everyone now has access to exchange-traded funds (ETFs). Due to their often passive nature, these funds don’t do any analysis and they systematically invest all available cash in the market. In addition, since most ETFs are based on market capitalization, they automatically buy larger companies, even though they are often overvalued. So these funds do the opposite of what you would expect from a conscientious manager: they buy the stocks that have risen the most. Like in a Ponzi scheme, everything is fine as long as new money comes into the market.

For example, at present, and particularly for the U.S. indices, only a small number of stocks are responsible for the total return. A bit like Nortel was in 1999. So it’s extremely difficult to diversify a portfolio while outperforming the index. I’ll give you a concrete example. A portfolio made up of Apple, Amazon, Facebook, Google and Microsoft would be as risky today as if we had bought Nortel, Cisco, JDS-Uniphase and Alcatel-Lucent in January 2000. So it’s quite normal to find in our clients’ portfolios, in addition to technology stocks, shares of banks and insurance companies. It’s much less exciting, but in the long run it also pays off, without the risk of extreme volatility.

For these reasons, our strategies generated a very average return in the first half of the year. However, in the current economic situation, that’s normal, especially after such a spectacular 2020. Given our historical ability to increase our added value during more challenging market periods, we’re very confident that our stock selection process can continue to make Rivemont the best place to grow an investment portfolio.

Insurance Project

People who know me know that I’m not a big fan of insurance. In fact, I have practically none. No life insurance, no disability insurance, no critical illness insurance. I still don’t understand why I would give my money to an insurance company, which will invest it and give it back to me later, while keeping the profit, of course.

Having said that, there are many people who don’t think like me – perhaps with good reason – and who need to feel a sense of security different from mine. There are also some very specific situations where insurance is an ideal solution, such as:

- temporary protection against a particular hazard;

- estate needs.

Of course, any insurance product designed to replace a more traditional investment should be avoided because of the high costs associated with it and the coverage that is rarely necessary and, above all, expensive.

In short, over the next year, we’ll be setting up an insurance service exclusively to meet the needs of Rivemont clients. The goal is obviously not to push or sell complex and often unnecessary insurance strategies, but to provide a turnkey service that will eventually include a comprehensive financial plan.

Our specialty will obviously remain portfolio management and the construction of portfolios with strong risk-adjusted performance. However, a number of clients have requested this and would prefer to deal only with us for all their financial needs. We believe more than ever that when it comes to insurance, a neutral, non-sales based approach is much more preferable. So we’re adding another string to our bow, but without changing the initial target of helping our clients’ achieve their financial goals.

Market Prospects

| Rivemont Investments | |||

| Subject | Question | Recommendation | Comments

|

| Allocation between equities and fixed income securities | Which are most interesting, stocks or bonds? | Underweight in bonds. | We recommend adding alternative investments to portfolios.

|

| Distribution between Canadian, U.S. and international securities

|

Which securities are most interesting: Canadian, U.S. or international? | U.S. equities still lead the pack | Consider a rotation from growth to value type. |

| Distribution between corporate and government bonds | Which are more interesting, corporate or government bonds?

|

Long-term government bonds aren’t very attractive. | We recommend the most defensive products and cash. |

| Investments in Canadian dollars or in foreign currency | Do investments in other currencies increase or decrease the total yield?

|

U.S. assets are still just as essential to our portfolios. | We do not anticipate any abrupt currency movements. |

Favorite Securities

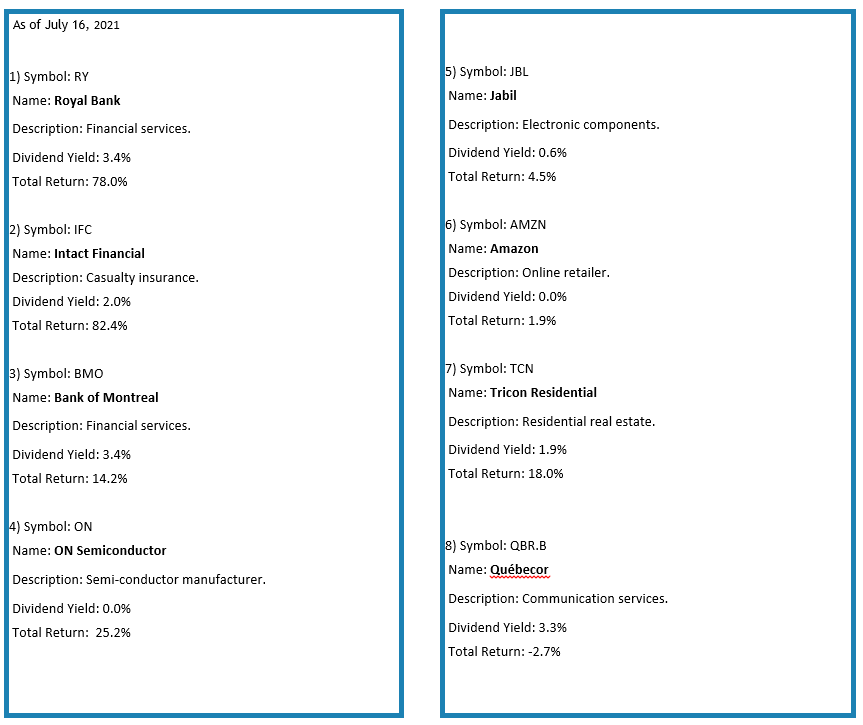

You will find below a list of the individual securities with the largest weight in our “growth” portfolio. These stocks were selected based on their respective potential to outperform the stock market. You will find a short description of their activities, the annual dividend, if any, and the total return since their first inclusion in our portfolio.

Conclusion

Before closing, for those of you who may be interested, I invite you to follow Rivemont and the Rivemont Crypto Fund on Facebook at:

https://www.facebook.com/Les-invesments-Rivemont-186748161338191/

https://www.facebook.com/rivemontcrypto

In addition, you can now follow me on Twitter at:

https://twitter.com/MartinRivemont

Rivemont is also on LinkedIn at:

https://ca.linkedin.com/company/les-investissements-rivemont

Thank you and have a sunny summer!

Martin Lalonde, MBA, CFA

President

The information presented is dated June 30, 2021 unless otherwise specified and is for information purposes only. The information comes from sources that we deem reliable, but its accuracy is not guaranteed. This is not financial, legal or tax advice. Rivemont Investments is not responsible for errors or omissions with respect to this information or for any loss or damage suffered as a result of reading it.

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.