Communications

Volume 11 Number 3

Introduction

Hello everyone,

Stock markets have a habit–good for some, annoying for others–of often doing the opposite of what the average investor expects. At the end of March, prophets of doom loudly proclaimed that the global financial system was on the brink of collapse because of the current crisis. They were proven wrong. Once again – history has been repeating itself for over 200 years – the North American stock market recovered in spectacular fashion. Of course, the current pandemic will have a longer-term impact on markets, and we must be prepared to turn defensive at the first signs of a downturn. However, as the ousted CEO of Citigroup aptly put it: “As long as the music is playing, you’ve got to get up and dance!”

Once again in this quarter, our trend following approach paid off. As of July 31, all our traditional strategies were positive for 2020 while the indexes remained in negative territory. Click on the link below to view the gross return of the equity portion of our portfolios:

https://rivemont.ca/wp-content/uploads/2020/07/Actions-2020-06-30.pdf

On a different note, Les Affaires Plus magazine regularly profiles a recognized Quebec investor. The Summer 2020 issue tells the story of Martin Lalonde, founder of Rivemont. I strongly urge you to take a look, especially if you don’t know me well.

https://rivemont.ca/wp-content/uploads/2020/06/image-ML-1-et-2.png

We begin this newsletter with an overview of the current crisis and its impact on financial markets, followed by an in-depth analysis of our investment decisions for the Rivemont Alpha Fund, which performed particularly well during the market decline. Then, as usual, we will present our market outlook and our largest positions.

Enjoy!

Coronavirus and Equity Markets

Borders are closed, events are cancelled, unemployment is on the rise and global growth is completely stalled. Nevertheless, the rebound in markets was as sharp as it was unexpected. The reason is obvious. A certain consensus now exists among financiers that the crisis is temporary, a vaccine will soon be developed and that there will be a strong rebound in consumer activity during the recovery. Although this might seem like an optimistic scenario, history teaches us that this is more or less what happened during previous pandemics, including the 1918-19 Spanish flu epidemic that preceded the Roaring Twenties.

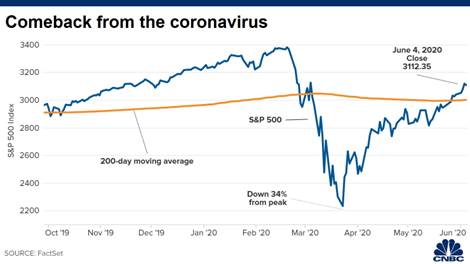

The chart above clearly illustrates a V-shaped recovery, where the strength of the rebound is commensurate with that of the decline that preceded it.

However, there is a big caveat here, because this recovery is one of the most uneven in history if we compare industries. In fact, big technology firms contributed almost all the gains in the major U.S. indexes, which partly explains the underperformance of the Canadian market over the same period. This situation resulted in two important consequences that investors must absolutely take into account in upcoming quarters.

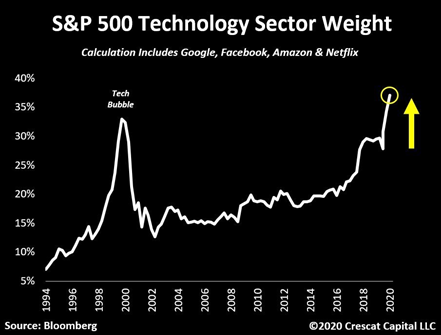

First, the five biggest technology companies now make up nearly 20% of the S&P 500, something that has not been seen since the tech bubble of the late 2000s.

Here is how each industry is trending among U.S. large caps:

Source : Siblis Research.

And here is the weighting of the four largest companies in the technology sector:

Currently, an investor choosing certain Exchange-Traded Funds would get a concentration that is possibly higher than desired along with less than optimal diversification.

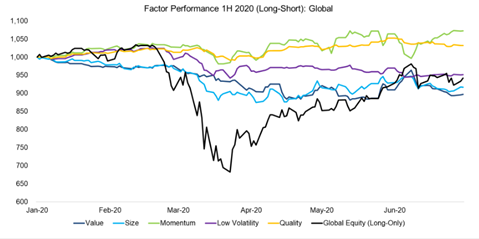

Second, the performance of the technology sector has meant that value strategies have produced mediocre returns over the past decade compared to growth strategies. Here is the return by investment style since January 1, 2020:

Source : Factor Research, Factor Olympics 1H 2020

Rivemont’s trend monitoring strategy has benefited its investors the most in 2020. It did better before, during, and after the crisis, across all strategies.

Rivemont Alpha Fund

As of July 30, 2020, the return of the Rivemont Alpha Fund stood at 13 % since its launch last January 1, while markets posted negative returns for the same period.

In the second quarter, we focused on long positions chiefly in two industries: gold and biotechnology. As a side note, we also integrated the IBB Exchange-Traded Fund (iShares NASDAQ Biotechnology Index) into traditional strategies during the quarter to seize on the current enthusiasm for this sector.

The Alpha Fund, which profits from rising and falling markets, is, in our opinion, perfectly constituted to take advantage of the current exaggerations. We can quickly build up or trim positions in order to profit from trends that are often short-lived, but strong, as the example below shows.

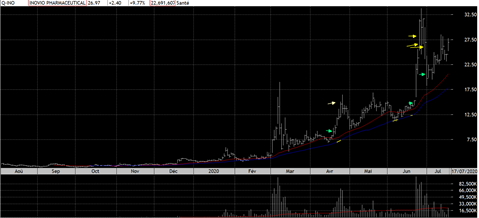

Inovio is a biotechnology firm currently working on a vaccine against COVID-19. We made our first purchase at around $9.25 and sold the stock at $15.75. We then repurchased the shares at $15 and sold them at about $27. Finally, we bought them once again at $22.

The company is without question on an upward trend, as is the entire industry to which it belongs. This is a perfect example of what we are trying to do with this fund. Of course, we will follow the same logic if a particular industry starts on a downward trend. We currently have few short positions, but this could change quickly.

Market Prospects

Favorite Securities

You will find below a list of the individual securities with the largest weight in our “growth” portfolio. These stocks were selected based on their respective potential to outperform the stock market. You will find a short description of their activities, the annual dividend, if any, and the total return since their first inclusion in our portfolio.

Conclusion

The returns we are currently generating relative to benchmarks cannot continue indefinitely. While we are fully confident that our strategy is working and will continue to work, a 27.4% gross return over three months for the equity portion of the portfolios exceeds the range of expected results. Let us take advantage of this windfall while there is still time to do so, while showing restraint. The market will soon bring us back to reality, as it always does.

Sincerely,

Martin Lalonde, MBA, CFA

President

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.