Communications

Volume 11 Number 1

Introduction

Hello everyone,

Sailing enthusiasts are well aware that it is always easier to sail with the wind at your back. That is exactly what happened this year. A strong tailwind pushed most stock market assets to record highs. For obvious diversification reasons, but also to protect against a bear market, our client’s portfolios are not invested entirely in equities. It would be easy to increase risk in this near-euphoric period, especially since we do not forecast any dark clouds in the short or medium term. But we must stick to the plan we have drawn up with each of our clients. There will be more difficult years ahead, and we must be prepared for these less sunny times.

We are pleased to welcome Tristan Ménard to our team. He will serve as Vice President, Business Development and will work mainly out of our Montreal office. Tristan was a partner and portfolio manager at Jarislowsky Fraser and was also Executive Vice-President, Capital Markets, for Nouveau Monde Graphite. We believe that his extensive experience, combined with our innovative approaches to portfolio building, will enable Rivemont to continue its spectacular growth of recent years. Welcome, Tristan!

We will begin this newsletter by reviewing the year in financial markets, including our assessment of the current situation, and continue with a more in-depth analysis of our investment decisions for the different strategies, in particular the MicroCap Fund, which performed especially well with a net return of 36.5% over the year. Also, the Rivemont Absolute Return Fund was terminated, and will be replaced by the Rivemont Alpha Fund. We will then wrap up, as usual, with our outlook for the market and our largest positions.

Enjoy!

2019

As we mentioned above, 2019 was a very good year on North American markets, with the best-performing markets gaining 20% in Canadian dollars. On our side of the border, gold, nonbank financials and high-tech were the most attractive sectors, while almost all industries moved higher on U.S. stock markets, including defensive sectors such as health care, real estate and utilities.

Although we started the year in a somewhat defensive position due to the December 2018 sell-off, we quickly became fully invested once again to profit from rising equity prices. A “winner takes all” theme quickly emerged in our stock selection. In our opinion, today’s global giants should in no way be concerned by the different antitrust agencies: no measures will be taken against them given the global competition that is increasingly pitting China against the West. For example, how could we ask Amazon to break itself up when it must face the Asian giants in many regions around the world?

That is why we added Google and Merck to our portfolios. Both are leaders in their respective fields, as are other companies in which we are invested, such as Docusign, Intact, Royal Bank and CAE.

You can see the returns of the equity portion of our portfolios by following this link:

https://rivemont.ca/wp-content/uploads/2020/01/Equities-2019-12-31.pdf

CAE

Trading View

CAE has been one of our biggest wins in recent years, delivering a return exceeding 100% since the company was added to the portfolio. A world leader in flight simulator design and pilot training, CAE is profiting from the increase in commercial flights worldwide and the advent of new types of aircraft. Boeing’s recent announcement calling for simulator retraining of all pilots of the infamous 737 MAX helped lift CAE’s shares more than 10% higher since the start of 2020.

GOOGL

Trading View

The scientific community has been dreaming about quantum technology, and the creation of a supercomputer or quantum processor, for decades. Operations would no longer be based on processing bits in a 1 or 0 state, but of qubits in both 1 and 0 states, a difference that will increase computing power exponentially. Last Fall, Google announced that it had managed this amazing feat, which is also called “quantum supremacy”. According to a scientific article published on October 23, a Google quantum computer performed a calculation in 200 seconds that would have taken 10,000 years with the most powerful conventional computer in the world.

It is difficult not to be astonished by this feat, and by the company’s enormous research and development investments that give it a considerable lead over its albeit almost non-existent competition. We therefore initiated a position at the $1,280 mark, and the shares have been climbing ever since.

Rivemont Microcap Fund

- $6.27 million in net assets under management

- 5% invested and 4.5% cash position

- 25 portfolio positions, the largest accounting for 18.6% of assets

- The top five holdings represented 45.9% of the portfolio

- Value per unit of $6.23, for a 12.1% return for the quarter (net of fees, Series B).

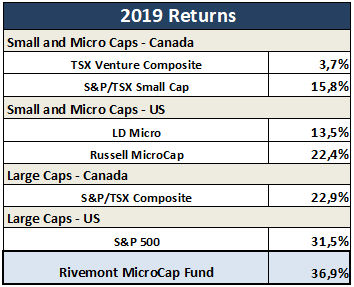

The first category in the table, representing small cap or microcap companies in Canada, is the most interesting to us because it is directly comparable with our investment strategy. That said, we still like to have an overall view of the market, that includes both the United States and large cap companies, in order to compare the performance of our asset class with that of other asset classes.

As the above table shows, the return of the Rivemont MicroCap Fund in 2019 is unequivocal: it outperformed the index across the board. Our strong outperformance of the Canadian market for the second year in a row shows that we are able to generate value through our active selection of microcap securities.

It has been mathematically demonstrated including microcap companies in a well-diversified large-cap portfolio can not only improve potential returns but also reduce the overall portfolio risk. Why? Because there is no perfect correlation between small and large cap companies. Sometimes one asset class goes up while the other goes down. Investing in both classes balances returns and reduces the volatility of the overall portfolio.

Valuation gap between small and large cap companies

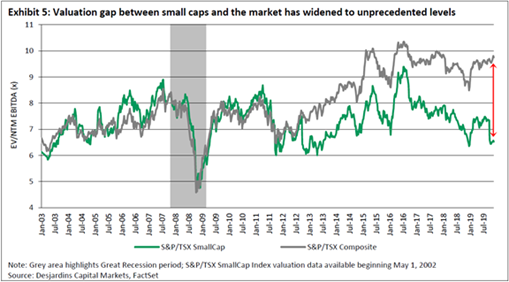

In December 2019, Desjardins Capital Markets published a report on the Canadian market outlook for 2020, with an emphasis on small cap companies.

This essentially means that, for several years now, investors have preferred large caps over smaller caps. In the longer term, chances are good that this trend will reverse. Remember that markets are cyclical and that gaps like this often revert to their historical average. If this happens, small-cap companies could beat the index for a few years, which would be very favourable for the Rivemont MicroCap Fund.

Rivemont Absolute Return Fund

The Rivemont Absolute Return Fund is the only relatively disappointing strategy in our clients’ portfolio (net average return of 4.5% since its inception in 2013). We therefore decided to terminate this product and replace it with the Rivemont Alpha Fund. This new strategy will eventually incorporate derivatives such as options and futures, following the Rivemont Investments’ registration with the Autorité des marchés financiers as a derivatives portfolio manager.

Market Prospects

| Rivemont Investments

|

|||

| Subject | Question | Recommendation | Comments |

| Allocation between equities and fixed income securities | Which are most interesting, stocks or bonds? | Still underweight in bonds. | We recommend adding alternative investments to portfolios.

|

| Distribution between Canadian, U.S. and international securities | Which securities are most interesting: Canadian, U.S. or international? | U.S. equities still lead the pack. | Gold is potentially starting an uptrend.

|

| Distribution between corporate and government bonds | Which are more interesting, corporate or government bonds? | Long-term government bonds are not very attractive. | We recommend high yielding bonds

|

| Investments in Canadian dollars or in foreign currency | Do investments in other currencies increase or decrease the total yield? | U.S. assets are still just as essential to portfolios. | We do not anticipate any sharp movement in currencies.

|

Favorite Securities

You will find below a list of the individual securities with the largest weight in our “growth” portfolio. These stocks were selected based on their respective potential to outperform the stock market. You will find a short description of their activities, the annual dividend, if any, and the total return since their first inclusion in our portfolio.

Conclusion

Although 2019 ended on a high note and 2020 is off to a good start, don’t forget that it is relatively easy to do well in times like this, and that even high-fee products lacking a superior strategy can produce satisfactory returns. As the ex-CEO of Citigroup said before the 2008-2009 fiasco, “As long as the music is playing, you’ve got to get up and dance!” However, you can be sure that there will be a shortage of chairs when the music stops. On the other hand, far be it from us to wish for the end of this historic bull market. But we will be prepared for it.

Sincerely,

Martin Lalonde, MBA, CFA

President

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.