Communications

Volume 10 Number 3

Introduction

Hello everyone,

The second quarter of 2019 was eventful for Rivemont. First, I would like to welcome Louis Natier to our Montreal office, where he will serve as an investment and administration analyst. Louis has a degree in finance and is pursuing the CFA designation. I would also like to wish a very special welcome to the clients of Christopher Roche, who are joining Rivemont. In partnership with Christopher, our team will offer you expert and personalized support in creating a high-performance portfolio that matches your risk profile.

We have also, for the first time in our history, received an investment mandate from a leading Quebec family office. This investment in the Rivemont MicroCap Fund marks a major milestone for a firm such as ours. We hope that this is only a beginning and that other institutions will take an interest in our innovative products.

On the markets, meanwhile, our traditional strategies slightly underperformed their respective indexes, by between 1% and 2%, over the last three months. An uneventful performance in an uneventful market. However, the alternative strategy on which most of the attention was focused in the last quarter was beyond a doubt related to cryptocurrencies. Although clearly very risky and volatile, and not for your average investor, the Rivemont Crypto Fund generated a return after fees of more than 140% during the period. We believe that, in a not-too-distant future, all firms will have to include this asset class in their clients’ portfolios. Let’s hope that the Rivemont Crypto Fund will be the product they choose at that time.

In this newsletter, we will review the last quarter and present our new purchases. As usual, we’ll wrap up with our outlook for the various asset classes and the largest positions in our traditional management mandates.

Enjoy!

The last quarter

Here is how our growth strategy performed:

https://rivemont.ca/wp-content/uploads/2019/07/Growth-2019-06-30.pdf

As you can see, we continue to do well while displaying less volatility than our benchmark index. We believe that it’s important to combine growth and income stocks in order to build a portfolio that performs well over the entire market cycle.

In recent weeks, we completed our purchases with two very different securities. First, we added Independence Realty Trust (IRT.N) to our strategies. This company owns 15,734 housing units in 58 communities throughout the United States. Most of these modern complexes include training facilities as well as swimming pools and spas.

Financially, the most attractive aspect of this investment is the annual dividend yield of over 6%. We obviously made sure that the company’s fundamentals could sustain it. In an environment of very low interest rates, with a potential further cut by the Fed later this year, we believe this industry is really well positioned for sustained growth over the next few years.

Our portfolio now holds three trusts, with a weight of about 15%. Operating in vastly different industries, these trusts complement each other well to generate high income, something that is increasingly difficult for bonds.

Our other purchase, although very different, is based on the same premise: the decline in U.S. interest rates. We believe that these rates will be trimmed from 0.25% to 0.50% this year. Indeed, inflation south of the border is lower than anticipated and trending downward due to a slowdown in certain components of GDP.

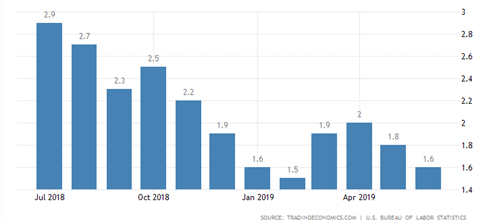

As shown on the chart above from the U.S. Bureau of Labor/Trading Economics, inflation remains below 2% despite a historically spectacular job market. Lower interest rates should cause the U.S. dollar to depreciate against other currencies, including the Canadian dollar since our economy is not experiencing the same concerns.

Source : Trading Economics

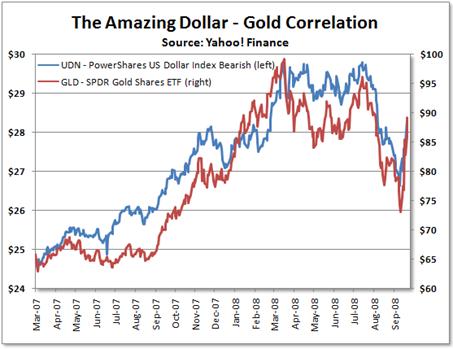

As the above graph shows, the loonie has gained nearly 4% over the past four months. And what asset class performs best when the U.S. dollar falls? Gold, obviously! The graph below illustrates this correlation.

Source : Tim Iacono, Seeking Alpha

In order to take advantage of this relationship, we added the XGD Global Gold ETF to the portfolios. The largest positions in that ETF are Newmont Goldcorp, Barrick Gold and Franco Nevada. It’s important to note that we prefer to invest in gold companies rather than in the price of gold itself. We believe that the leverage created by rising commodity prices is always beneficial to mining companies in the industry when the market is on the rise. The graph below shows the price of gold over the past five years. An interesting upward trend is taking shape.

Source : Kitco

Market Prospects

| Rivemont Investments

|

|||

| Subject | Question | Recommendation | Comments |

| Allocation between equities and fixed income securities | Which are most interesting, stocks or bonds? | Underweight in bonds. | We recommend adding alternative investments to portfolios.

|

| Distribution between Canadian, U.S. and international securities | Which securities are most interesting: Canadian, U.S. or international? | Canadians equities are making a strong come back. | Gold may be making a much-anticipated return.

|

| Distribution between corporate and government bonds | Which are more interesting, corporate or government bonds? | Long-term government bonds are not very attractive. |

We recommend bonds with medium-term maturities.

|

| Investments in Canadian dollars or in foreign currency | Do investments in other currencies increase or decrease the total yield? | U.S. assets are still just as essential to portfolios. | We do not anticipate any sharp movement in currencies.

|

Favorite Securities

You will find below a list of the individual securities with the largest weight in our “growth” portfolio. These stocks were selected based on their respective potential to outperform the stock market. You will find a short description of their activities, the annual dividend, if any, and the total return since their first inclusion in our portfolio.

Conclusion

Active management is again becoming critical if we wish to direct our portfolios to securities that reflect dominant economic trends. In Canada, we don’t expect the petroleum industry to bounce back, as a decline in global consumption is anticipated over the next decade. Rates should remain low and the second half of the year could see the start of a race to currency depreciation.

Unlike several other observers, we’re not so convinced that a trade deal between China and the U.S. is imminent. China will probably stick to its guns and it will take a reasonable Trump to break the deadlock. Is this possible?

Sincerely,

Martin Lalonde, MBA, CFA

President

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.