Communications

Volume 10 Number 1

Introduction

Hello everyone,

In our last communication, I mentioned the importance of active management, as advocated by Rivemont, and how it can protect our investors’ capital during market downturns. And we definitely can say that the last quarter of 2018 allowed us to concretely put this particular aptitude to the test. That highly volatile period ended with a sharp drop in equities on all the world markets. The slide was especially severe for U.S. technology large caps, led by Apple, which adjusted its sales forecast downward, leading to the loss of nearly one-third of its market capitalization.

Meanwhile, we had sold many shares in that category in late fall and significantly increased our level of cash to over 30%. Combined with our good returns in the first half of the year, these decisions ensured that all our traditional strategies ended in positive territory for 2018, placing us clearly in a class apart in comparison to our competitors. The Rivemont Absolute Return fund also did well, with a return of 12.4% in December alone.

We will begin this newsletter with a review of last year on the financial markets, including our assessment of the current situation, followed by a more in-depth analysis of our investment decisions for our various strategies. Then, as usual, we’ll wrap up with our market outlook and an outline of our most important positions.

Before we go any further though, I would like to mention once again that the Rivemont Crypto and Rivemont Microcap funds have their own newsletter. Please write to info@rivemont.ca to subscribe.

2018 in Review

It is often said that a picture is worth a thousand words, so let’s borrow a page from our colleagues at RBC Wealth Management and the Les affaires newspaper with this chart showing the return on various asset classes in 2018.

A quick glance shows how hard it was to avoid a decline this year. The U.S. market was one of the top performers, with a negative return of 4.4%, while the Canadian market lost about 9% over the same period. Abroad, the European and emerging markets each lost about 15%.

Commodities, which are usually not perfectly coordinated with the equities markets, also lost ground when gold dropped by 5% and oil by nearly 20%. Only bonds managed to protect portfolios by earning a slightly positive return.

Elsewhere in the world, some countries suffered a harsh setback (especially when the return is calculated in U.S. dollars). At the bottom of the class, Venezuela lost 95% of its value due to uncontrolled hyperinflation. Needless to say, President Maduro has his work cut out for him, having been recently accused by many western leaders of installing an anti-democratic regime (no surprise there!). Elsewhere in the Americas, the Argentine market closed out 2018 with a negative return of 50%, due to the decline of the currency and falling commodity prices. In Europe, the Turkish market dropped by 43%, due in part to very shaky currency, but also because of tense relations between Trump and Erdogan. Finally, the over 28% decline in the Chinese market cannot be ignored, stemming, in no small measure, from the increasing tensions between China and our neighbours to the south. Unlike many others, we believe that the Chinese are suffering the most in this situation, which may give Trump and his administration a valuable negotiating tool.

All that aside, there is positive news to be found. The markets in Ukraine and Macedonia, with returns of 80% and 30%, respectively, turned in the best performance of the year, followed by Qatar (21%), the United Arab Emirates (12%) and Saudi Arabia (9%). The low capitalization in these markets makes it almost impossible to invest there, however.

It is hard to report on the 2018 markets without mentioning equities related to the cannabis sector. From January to October, shares in this sector climbed exponentially and then, like the rest of the market, came back down to more normal levels. The best example is Tilray (TLRY), which went from $25 on the Nasdaq in August up to a peak of $300 in September. The Canadian market was not left out, of course, with Aleafia Health (ALEF), for example, jumping from $0.70 in August to $4.50 in September. In our opinion, similar occasions will also arise in 2019, when many more companies in this field will go public. We are keeping our eyes peeled to take a position in this sector with the Rivemont Absolute Return fund, as we did with Aleafia Health in third quarter 2018.

Current Situation

As you know, Rivemont specializes in a technical approach to trend following. We do not try to predict the direction of the market but to harmonize with it. Even if we think the market may be overvalued, especially the U.S. markets, we will not hesitate to redeploy our capital if the known decline at the 2018 year-end turns out to be just a correction in the bull market we have enjoyed for ten years now. At the same time, several indicators suggest we should remain cautious.

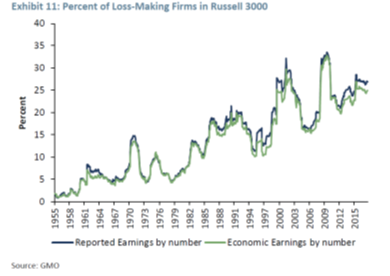

The Russel 3000 index includes the 3,000 largest American public corporations, which constitutes about 98% of the total equity market. Currently, over 25% of those corporations are not turning any profit and are, in fact, suffering losses.

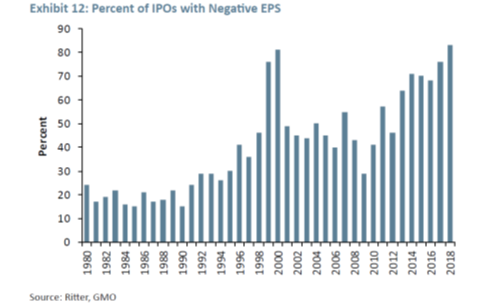

As the graph above shows, that percentage has only been higher twice, in 2000 and 2008 – in other words, in very bad years for capital deployment. Likewise, the graph below shows that corporations issuing public offerings (IPO) are also having trouble making a profit, at rates that are about to outstrip those in 1999.

Finally, the last issue I want to discuss today is of particular interest. It is widely known that individual investors have the bad habit of entering and leaving the stock markets at the worst moments. Few – although I know a handful – take advantage of market downturns to increase their savings. Usually, people prefer to invest when the market is doing well and, sometimes, unfortunately, they sell when the tides turn, when the reverse would actually be the right course for optimizing return.

Now, for the first time since the 1990s, individual investors have become net buyers of equities, when they have been, in general and over the long term, sellers. This does not necessarily mean that a shift is about to occur. Often, a euphoric and volatile period precedes a fall, which may create good buying opportunities, as it did in 1995 and 1996. We should point out, though, that we think, especially for U.S. large caps and for the medium term, that the best is probably behind us.

Luckily, this situation should create good opportunities in currently less-attractive market sectors. And this is when active management is so appealing to investors. For example, we believe that the emerging markets are becoming increasingly attractive, as are the resource sector and commercial real estate (warehouses, etc.). Every phase of the market cycle offers opportunities. Furthermore, since the Rivemont Absolute Return fund can benefit from rising markets as well as falling markets, we feel that our potential to outperform the markets is better than ever.

Our return for 2018

Traditional Strategies

https://rivemont.ca/wp-content/uploads/2019/01/Rivemont-Croissance-agressive-2018-12-31-1.pdf

Three main factors explain our returns in 2018. First, we avoided the resource sector. With a barrel of oil losing nearly 20% of its value, some companies in this sector were more affected than others. Currently, there is a serious oil transportation problem in Canada, and these difficulties do not seem anywhere near resolution.

The second factor was the addition of U.S. tech companies to the portfolios at the beginning of the year, especially ETSY and TDOC, which achieved a spectacular return, as did the Nasdaq overall during that period.

The last factor was the increase in cash in the early fall. We sold equities without replacing the positions, which allowed us to partly avoid the major losses in October and December on the markets.

Some of our competitors’ funds or strategies lost between 15% and 25% of their value in the last quarter of 2018. It is at times like these that an active capital protection strategy shows its true worth.

Market Prospects

| Rivemont Investments

|

|||

| Subject | Question | Recommendation | Comments |

| Allocation between equities and fixed income securities | Which are most interesting, stocks or bonds? | Underweight in bonds and stocks. | We recommend adding alternative investments to portfolios.

|

| Distribution between Canadian, U.S. and international securities | Which securities are most interesting: Canadian, U.S. or international? | International Equities are starting to look more attractive. | We are keeping a close eye on a potential resurgence of the commercial real estate sector.

|

| Distribution between corporate and government bonds | Which are more interesting, corporate or government bonds? | Long-term government bonds have little attraction. |

We recommend bonds with short-term maturities.

|

| Investments in Canadian dollars or in foreign currency | Do investments in other currencies increase or decrease the total yield? | U.S. assets are still just as essential to portfolios. | We do not anticipate any sharp movement in currencies.

|

Favorite Securities

You will find below a list of the individual securities with the largest weight in our “growth” portfolio. These stocks were selected based on their respective potential to outperform the stock market. You will find a short description of their activities, the annual dividend, if any, and the total return since their first inclusion in our portfolio.

Conclusion

Until we see whether the January rebound is permanent or temporary, we are keeping our liquidity levels high, so we are still positioned very defensively.

I encourage you to share this financial newsletter with your friends and family. Some investors had a fairly painful 2018, and they may benefit from more active management of their portfolio with systematic trend following.

And, in closing, I want to announce that this month, Rivemont Investments is entering its tenth year of existence. These ten wonderful years have been filled with very interesting challenges, and time has passed far faster than I wished. I want to thank you for your loyalty and confidence in Rivemont. Our clients are also our friends, and that is what makes our work so gratifying.

Thanks again,

Martin Lalonde, MBA, CFA

President

Interested in this newsletter?

Download it in PDF format to keep it.

Stay up to date!

Receive financial newsletters by email:

Similar letters

Volume 15 Number 1

The year is coming to an end on the markets, and they are still riding the bull wave that began in 2021. However, we are at a crossroads, and the coming weeks will be critical in determining with greater certainty the next stock index trends.

Read more >Volume 14 Number 4

That being said, the beauty, if not the benefit, of active management is that it is fortunately possible to remain underweight in certain asset classes. In addition, even when markets are stagnating, there are still opportunities in specific sectors.

Read more >Make an appointment today

Make an appointment today with our portfolio manager.

We will be happy to contact you within the next 48 hours. For any questions, do not hesitate to contact us directly.

Subscribe to our financial letter!

On a quarterly basis, we mail out a financial letter to all of our current and potential clients.

In order to be added to the mailing list, please enter your full name and email address below.